IRS 1099 Form Changes That Impact Creators

IRS 1099 Form Changes That Impact Creators in 2025: Why They Matter More Than You Think

The IRS made a few behind-the-scenes changes this year, and if you're a digital creator or entrepreneur, these updates aren’t just “good to know.” They directly impact how (and whether) you get those pesky forms in the mail.

I won’t drown you in tax jargon. You need translation, not confusion, so you can avoid messes later.

Let’s get into the creator-friendly breakdown:

1. The $600 Rule? Still On Hold, For Now.

Let’s start with the headline everyone’s been whispering about:

The IRS has once again delayed the drop to a $600 reporting threshold for 1099-Ks.

Here’s what’s staying put; at least for 2025:

✔️ Over $20,000 in total payments

✔️ Over 200 transactions

If you don’t hit both, Stripe, PayPal, Etsy, and Shopify won’t send you a 1099-K.

But here’s where things go sideways for creators:

Just because you didn’t get a form…

❌ Doesn’t mean the income isn’t taxable.

❌ Doesn’t mean you should send a 1099-NEC to someone who paid you through those platforms.

This is exactly how double reporting happens, and how IRS letters land in your in-box with a thud.

2. 1099-NEC Is Becoming the Default, Again

The IRS is still tidying the house and shifting more payments over to the 1099-NEC.

Translation:

If you paid someone for actual work, like coaching, copywriting, design, admin support, assume it’s 1099-NEC territory.

Use 1099-MISC for things like:

• Rent

• Royalties

• Prizes

• Miscellaneous payments

But labor?

🛑 That’s NEC, every time.

3. “Do I Send the Form… or Does the Platform?" The Question That Trips Up the Smartest Creators

Here’s the cheat code:

👉 If you paid a contractor from your business bank account

(ACH, check, Zelle, bill pay)

➡️ YOU issue the 1099-NEC.

👉 If you paid them through PayPal Business, Venmo Business, Stripe, or a credit card

➡️ YOU DO NOT issue a 1099.

These are third-party payment processors, they handle reporting.

👉 If you used a payroll service (Gusto, QuickBooks Payroll, etc.)

➡️ It depends on your settings.

If you’ve enabled contractor filings, they’ll issue the forms. If not, you’re responsible.

📌 Double-check your payroll settings now, not in January.

Get this wrong, and here’s what happens:

You issue a 1099…

The platform issues a 1099-K…

Your payroll provider issues another 1099…

The IRS sees double, or triple, the income.

They’re not accusing you of fraud.

But mismatches = letters, audits, and unnecessary panic.

Why These Rules Hit Creators Harder Than Anyone

If you’re a coach, creator, or digital entrepreneur, your income doesn’t flow in from one tidy paycheck.

It comes from Stripe, PayPal, Etsy, Shopify, Thrive Cart, Kajabi, affiliate platforms, and brand deals.

One offer sells, and suddenly three platforms are in the mix, and five ways for the data to get messed up.

When your tax return shows $85,000 in revenue and Stripe tells the IRS $91,000, guess what happens?

The IRS doesn’t shrug.

They send a letter.

You scramble.

Your tax pro sighs. Nobody wins. Let’s skip that drama

Why Creators’ Books Often Don’t Match IRS Reports (Patterns I See Every Week)

🔁 #1: Double counting

The same $997 course gets recorded through Kajabi, Stripe, and your bank feed. Nobody catches the triple dip.

📊 #2: Chart of accounts is a hot mess

If everything is categorized under “admin” or “other,” your 1099 reports will always be wrong.

📇 #3: Vendors misclassified or missing W-9s

They’re 1099-eligible, but the system doesn’t know that.

💸 #4: No tracking of how vendors were paid

If you paid Jane half via bank transfer and half via PayPal, but your accounting software doesn’t know the difference… her 1099 will be wrong.

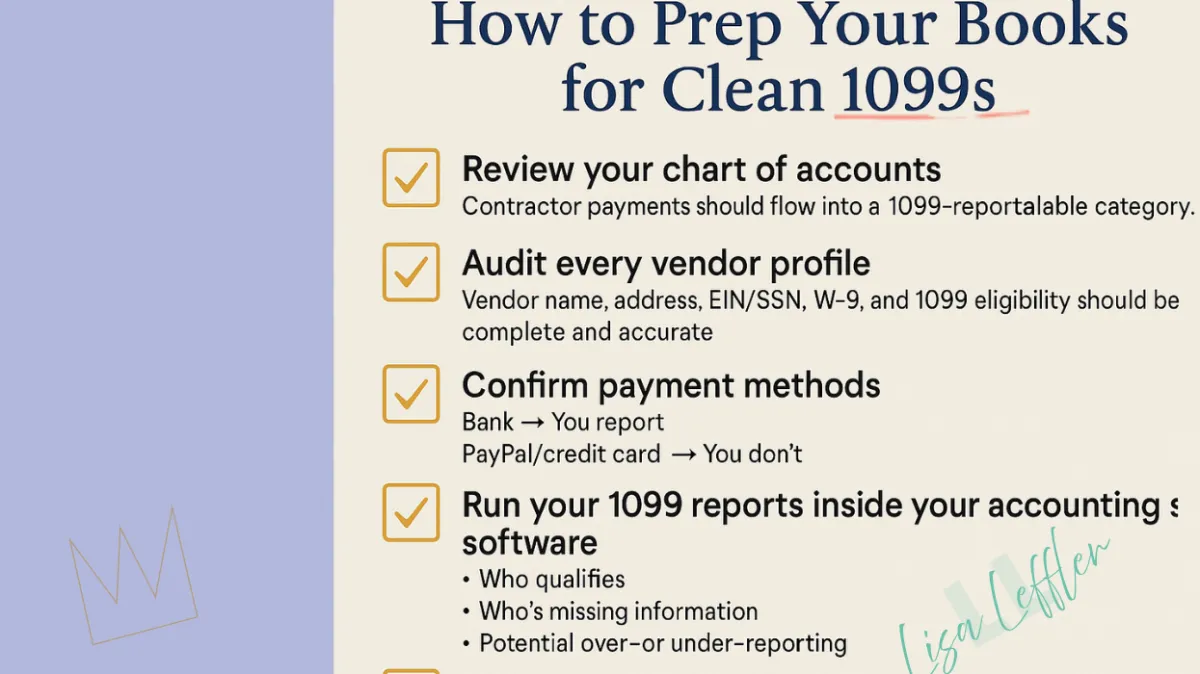

How to Prep Your Books for Clean 1099s

No Stress. No Spreadsheet Panic.

Here’s your creator-proof checklist:

✔️ Review your chart of accounts

Contractor payments should flow into a 1099-reportable category.

✔️ Audit vendor profile’s in your accounting software

Vendor name, address, EIN/SSN, W-9, and 1099 eligibility should be complete and accurate. Don't wait until year end to do this part! Do this throughout the year or when you set up your vendors in your accounting system to avoid the scramble later.

✔️ Confirm payment methods

Bank → You report.

PayPal/credit card → You don’t.

QuickBooks + Xero can exclude processor payments automatically…

IF the vendor is set up correctly.

✔️ Run your 1099 reports inside your accounting software

It will show you:

• Who qualifies

• Who’s missing information

• Potential over- or under-reporting

✔️ Reconcile your platform payouts monthly

Stripe, Shopify, Kajabi, PayPal, your books should match platform payouts line-by-line.

No surprises in January.

No tears in February.

No IRS letters in April.

Big Picture: It’s Not About the Forms, It’s About the Foundation

You can’t control when the IRS changes its mind.

But you can control:

✔️ Clean books

✔️ Clean systems

✔️ Clean vendor records

✔️ Clean reporting

When your backend works:

You scale without chaos.

You make smarter decisions.

You stop running your business on guesses.

You stop flying blind.

Clean books are not a luxury; they’re your protective shield.

🔥The Tough-Love Accounting Moment: Clean Books, No BS

If you read this and thought:

“Oh crap, I’ve definitely double-counted Stripe payouts…”

“My 1099s were a mess last year…”

“My books might as well be a Choose-Your-Own-Adventure novel…”

Then you’re who I help.

👉 Let’s schedule a call and look under the hood, what’s working, what’s messy, and what needs to be fixed before reporting season lands like a tax-shaped meteor.

Stop hoping your spreadsheets are right.

Let’s make them right.